QuickBooks program has been facing certain issues while users try to take out taxes. One typical error that shows up is ‘QuickBooks payroll is not taking out taxes’. Due to multiple factors, the payroll item might not compute taxes correctly. Use the recommendations contained in this article to determine the various factors that may be causing this inconsistent behavior in QuickBooks payroll.

You are required to check if a payroll item for a deduction is set to calculate using Net or Gross. Depending on the choice selected, the computation could change. To confirm the configuration of a setting's calculation, follow the trails laid down below:

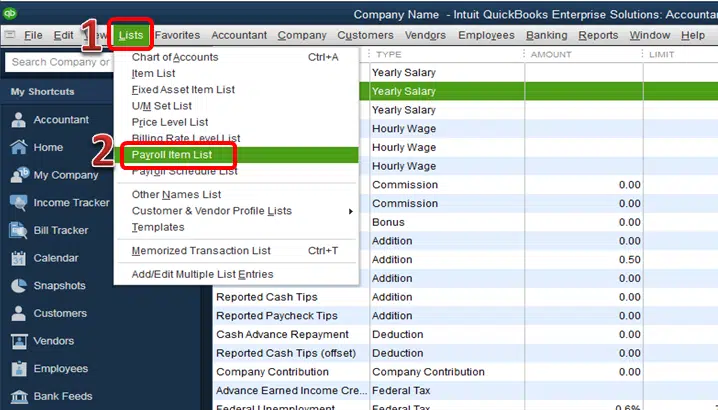

- From the top menu bar, opt for ‘’Lists’’ and ‘’Payroll Item List.’’

- When you right-click the deduction that you want to review, hit on ‘’Edit Payroll Item.’’

- Click ‘’Next’’ when the ‘’Gross vs. Net’’ screen appears.

- Verify that the selection is accurate.

- Proceed ahead by selecting ‘’Next’’ until the Finish button appears.

- Hit on ‘’Finish.’’

- Note: Certain deductions may vary based on what the responsibility agency demands. For further information on calculating this specific deduction, consult the agency's rules.

- Check it out to see if the calculation affects the order in which the payroll items are listed.

- Payroll items are calculated based on how the elements are arranged in the ‘’Other Payroll’’ Items section of the paycheck.

For example, if you have a deduction item set to calculate based on gross pay and this item is listed under Other Payroll Items second to an Advance addition item, the deduction item would calculate first, and the deduction would be based on the combination of the gross earnings items plus the Advance.

- Check the sequence of the payroll elements on your paycheck to see whether they affect the calculation.

- If you want the payroll item to be calculated purely based on the employee's wages, it should be the first item in the Other Payroll Items section of the paycheck.

- After any additions or deductions, you choose to include in the calculation, add the payroll item.

- Verify whether the payroll item is set up to compute based on the amount, hours, or neither.

- Payroll items can be configured to calculate based on the amount, hours, or neither. If a payroll item is set to compute based on amount or hours, you must manually input the quantity or number of hours in the Quantity field in the Preview Paycheck box.