Linerboard, a key material used in the production of corrugated boxes and packaging, has experienced significant price movements influenced by various economic and market factors. This article provides a comprehensive analysis of the historical price trend of linerboard, factors affecting these trends, and the forecast for 2024.

Historical Overview of Linerboard Prices

Recent Price Movements (2021-2023)

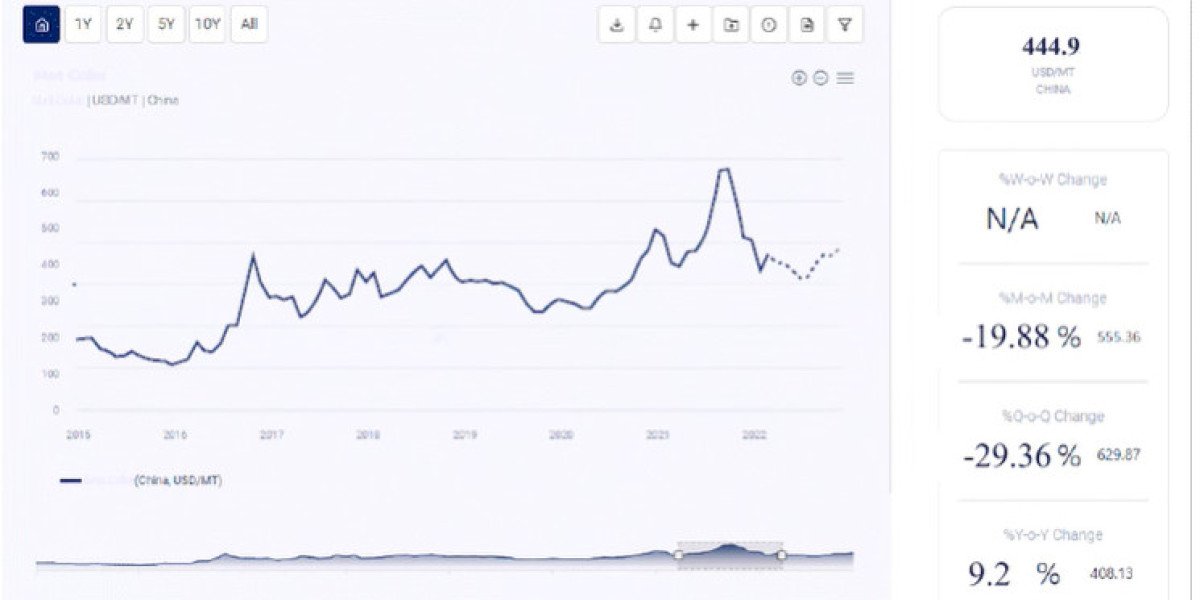

In recent years, linerboard prices have seen considerable volatility. The COVID-19 pandemic caused a surge in demand for packaging materials due to increased e-commerce, leading to significant price hikes. For instance, prices rose by about $220 per ton from mid-2020 to early 2022. However, prices began to stabilize and eventually decline in late 2022 and 2023, influenced by supply chain improvements and reduced demand from the cooling of pandemic-driven consumption.

By the end of 2023, the price of linerboard in North America had seen a slight uptick due to renewed demand from various industries. Prices were reported to have risen from $730-750 per ton before leaving the mill to about $740-760 per ton by January 2024.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/linerboard-price-trends/pricerequest

Factors Influencing Linerboard Prices

1. Supply Chain Dynamics

The supply chain disruptions caused by the COVID-19 pandemic had a lasting impact on linerboard prices. While initial disruptions caused prices to spike, subsequent improvements and adjustments led to stabilization. However, ongoing challenges such as transportation costs and raw material availability continue to influence prices.

2. Raw Material Costs

The cost of raw materials, particularly wood pulp, plays a crucial role in determining linerboard prices. Fluctuations in wood pulp prices due to changes in production levels, environmental regulations, and geopolitical factors directly impact the cost of linerboard production.

3. Demand from Key Industries

The demand for linerboard is closely tied to the packaging needs of various industries, including e-commerce, food and beverage, and consumer goods. The growth of e-commerce during the pandemic significantly increased demand for corrugated packaging. Although demand has cooled somewhat, it remains strong due to ongoing reliance on online shopping and shipping.

4. Economic and Geopolitical Factors

Global economic conditions and geopolitical events also influence linerboard prices. Economic slowdowns can reduce industrial demand, while geopolitical tensions can disrupt supply chains and lead to price volatility. For example, the Russia-Ukraine conflict has had ripple effects on global logistics and material costs.

Price Forecast for 2024

Expected Price Range

Analysts predict that linerboard prices will experience some stability with potential for moderate increases in 2024. The expected price range is between $740 and $800 per ton. This forecast considers several factors, including steady demand from key industries, gradual economic recovery, and potential supply chain adjustments.

Potential Scenarios

- Optimistic Scenario: If economic conditions improve and demand from e-commerce and industrial sectors increases, prices could trend towards the higher end of the forecast range ($780 to $800 per ton).

- Pessimistic Scenario: Conversely, if economic growth slows and demand decreases, prices might settle at the lower end of the forecast range ($740 to $760 per ton).

Strategic Insights for Stakeholders

For Consumers

Consumers, especially those in industries relying heavily on packaging, can manage costs by purchasing linerboard in bulk during periods of lower prices and negotiating long-term contracts with suppliers to lock in favorable rates.

For Producers

Producers should focus on optimizing production processes and securing stable supply chains. Investing in sustainable practices and diversifying sources of raw materials can help mitigate the impact of price volatility.

For Traders and Investors

Traders and investors should monitor market trends closely and use financial instruments such as futures contracts to hedge against price volatility. Keeping abreast of geopolitical developments and economic indicators will be crucial for making informed trading decisions.

Conclusion

The linerboard market in 2024 is expected to be influenced by a complex interplay of supply chain dynamics, raw material costs, and demand from key industries. While prices are anticipated to remain stable with a potential for moderate increases, strategic planning and adaptability will be essential for stakeholders to navigate the market effectively. By understanding the underlying factors and staying informed about market trends, consumers, producers, and traders can make better decisions and capitalize on emerging opportunities in the linerboard market.