- Bitcoin recovered 16% from its $90,000 low following Trump’s pro-crypto policy announcements.

- XRP’s market capitalization reached $190 billion after Ripple executives met with Trump’s team.

- Coinbase launched a tax-optimized lending program using bitcoin as collateral via Morpho protocol.

- Trump and Melania-themed tokens achieved $9.7 billion combined market cap within three days.

- Token lock-up periods prevent immediate liquidation of Trump-affiliated crypto holdings.

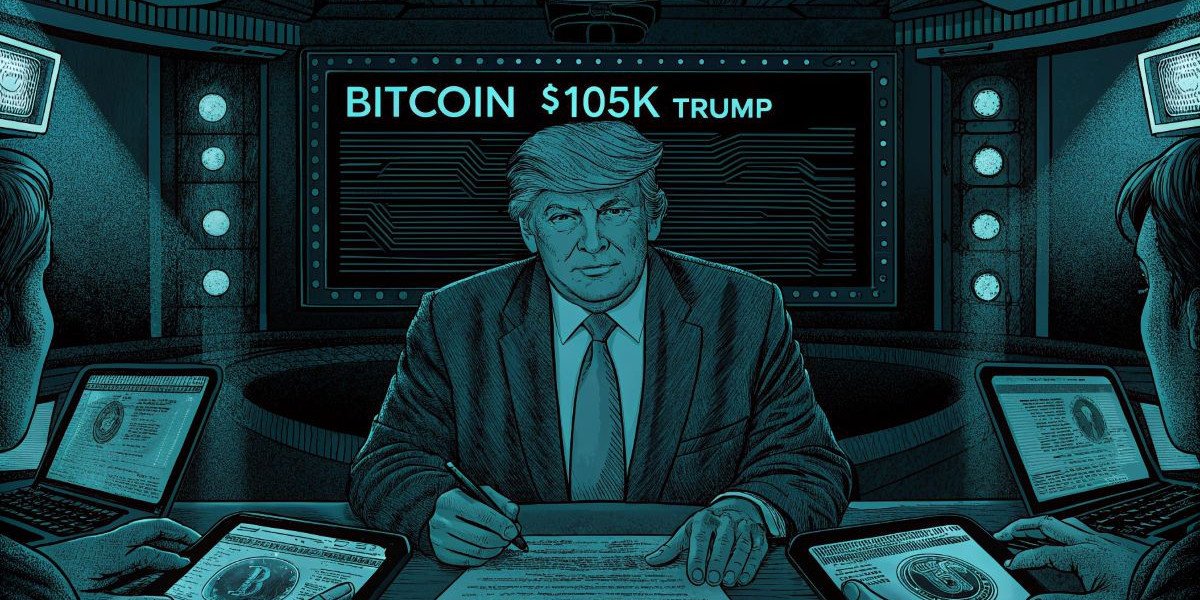

Bitcoin's Rally and Regulatory Optimism

Bitcoin surged past $105,000 on Friday, recovering from a mid-week dip below $90,000 as investors anticipate favorable cryptocurrency regulations under President Donald Trump.

The rally coincides with XRP reaching a record $3.4 valuation and Coinbase launching a bitcoin-backed lending service.

Meanwhile, Trump-themed tokens dominate decentralized exchanges, with TRUMP and MELANIA tokens amassing over $9.7 billion combined market capitalization within days.

Trump’s transition team is preparing an executive order to establish federal cryptocurrency reserves and an industry advisory council, according to sources familiar with the matter.

This follows Ripple CEO Brad Garlinghouse’s private discussions with Trump about regulatory frameworks, as reported by the New York Times.

XRP's Ascent and Ripple's Strategic Moves

XRP climbed 40% this week to $3.40, its highest price since inception. The token’s $190 billion market capitalization now rivals traditional financial institutions, fueled by speculation that the Trump administration may resolve Ripple’s ongoing legal challenges with the SEC. The company recently expanded its product suite with RLUSD, a stablecoin operating on both Ethereum and XRP Ledger networks.

Garlinghouse confirmed Ripple’s collaboration with federal policymakers, stating: ”Our dialogue focuses on creating clarity for enterprises and consumers alike.”

The company’s contributions to Trump’s inaugural committee underscore its political engagement.

Coinbase Innovates with Bitcoin-Collateralized Loans

Coinbase reintroduced cryptocurrency lending through a program allowing U.S. users to borrow up to $100,000 in USDC stablecoins using bitcoin as collateral - according to Bitnewsbot. The service, built on Morpho’s protocol via the Base blockchain, requires borrowers to maintain a minimum 86% collateral ratio to prevent liquidation.

By converting bitcoin to cbBTC tokens, users avoid capital gains taxes associated with direct sales. The approach mirrors decentralized finance (DeFi) protocols like pioneer NEXO, where over-collateralization—posting more collateral than the loan value—reduces default risks. Coinbase plans to expand supported assets beyond bitcoin in coming months.

Trump Token Phenomenon Reshapes Memecoin Market

Trump-affiliated tokens dominated trading activity, with the official TRUMP token on Solana reaching an $8.8 billion market cap before settling at $38. The subsequent MELANIA token launch absorbed $945 million in market value within hours.

World Liberty Financial, backed by Justin Sun’s $45 million investment, acquired Ethereum Name Service (ENS) domains like trumpcoin.eth, hinting at future token releases.

Unofficial memecoins representing Trump’s children briefly captured investor attention. A Barron-themed token generated $800 million in trading volume before plummeting 80%, highlighting the volatility of politically-linked assets. Cryptocurrency analyst Peter Schiff remarked: ”This is speculative mania disguised as political endorsement.”

Valuation Realities and Market Constraints

Despite paper valuations exceeding $2.3 trillion for Trump-linked tokens, liquidity limitations render these figures theoretical.

The TRUMP treasury holds $35.5 billion in tokens, but liquidating even 1% would require buyers for $355 million—equivalent to 4% of the token’s total market cap.

Vesting schedules further restrict sales: TRUMP tokens are locked for three months, while MELANIA holders face a 30-day delay. These mechanisms, common in traditional crypto projects, aim to prevent sudden sell-offs. For context, Litecoin’s $9.8 billion market cap reflects eight years of trading history and distributed ownership.