"Loan Servicing Software Market Size And Forecast by 2029

The Loan Servicing Software Market is an evolving industry that holds significant potential across various sectors, driven by advancements in technology, shifting consumer preferences, and growing demand for innovative solutions. With a robust ecosystem of players and a dynamic competitive landscape, the market offers ample opportunities for growth and value creation. This report delves into the size, share, and scope of the Loan Servicing Software Market, providing a detailed analysis of its current state and future outlook.

The loan servicing software market is expected to witness market growth at a rate of 12.62% in the forecast period of 2022 to 2029.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-loan-servicing-software-market

Which are the top companies operating in the Loan Servicing Software Market?

The Top 10 Companies in Loan Servicing Software Market include leading industry players that have established a strong presence through innovation, quality products, and strategic partnerships. These companies dominate the market by leveraging advanced technologies, extensive distribution networks, and a deep understanding of consumer needs. Their market leadership is often driven by significant investments in research and development, as well as their ability to adapt to changing market trends and consumer demands.

**Segments**

- **Type:** The loan servicing software market can be segmented based on the type of software, including cloud-based and on-premise solutions. Cloud-based software offers flexibility and scalability, while on-premise solutions provide higher security and customization options.

- **End-User:** The market can also be segmented by end-user industry, such as banking, financial services, and insurance (BFSI), healthcare, manufacturing, retail, and others. Each industry has specific requirements for loan servicing software based on regulatory compliance, data security, and customer service.

- **Deployment:** Another important segment is deployment mode, which includes cloud deployment and on-premise deployment. Cloud deployment is gaining popularity due to its cost-effectiveness and ease of implementation, whereas on-premise deployment offers greater control over data and customization.

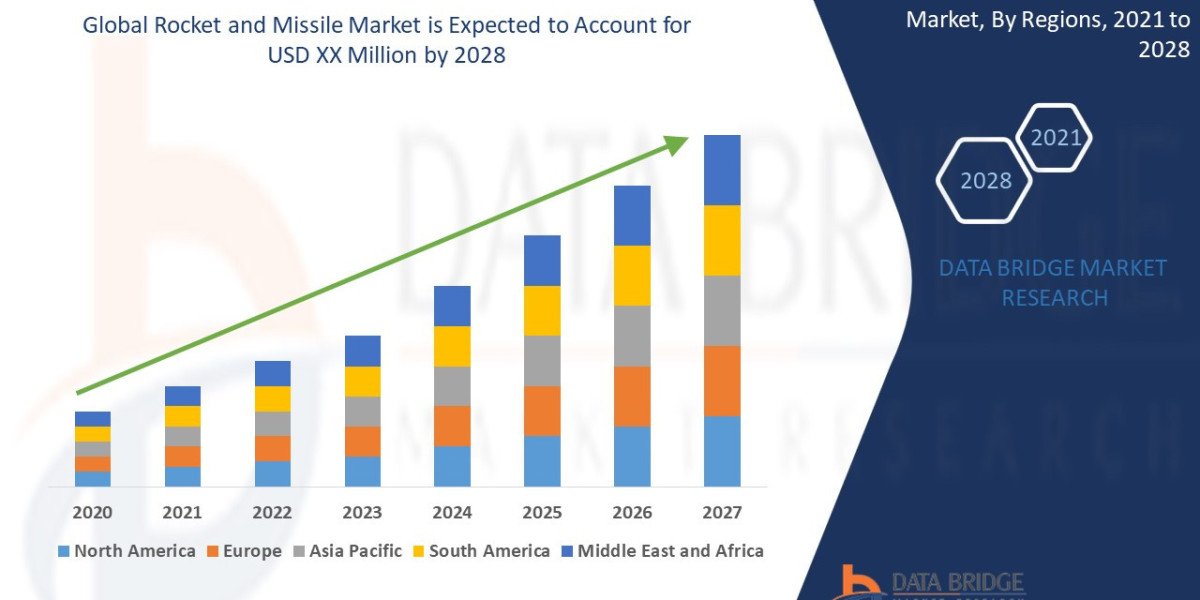

- **Region:** Geographically, the global loan servicing software market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Each region has specific market dynamics, regulatory environments, and competitive landscapes that influence the adoption of loan servicing software.

**Market Players**

- **Fiserv, Inc.:** Fiserv is a leading provider of loan servicing software, offering a comprehensive suite of solutions for banks, credit unions, and financial institutions. Their software includes features for loan origination, servicing, collections, and reporting.

- **FIS Global:** FIS Global is another key player in the loan servicing software market, known for its innovative technologies and industry expertise. Their software solutions help financial institutions streamline loan servicing processes and improve operational efficiency.

- **Finastra:** Finastra is a global provider of financial services software, including loan servicing solutions for banks and credit unions. Their software offers advanced features for loan management, customer communication, and compliance with regulatory requirements.

- **Jack Henry & Associates:** Jack Henry & Associates offers loan servicing software for community banks and credit unions, focusing on user-friendly interfaces and robust functionality. Their solutions help financial institutions automate loan servicing tasks and enhance the borrower experience.

- **Temenos Group:** Temenos Group is a leading provider of banking software, offering loan servicing solutions for retail and commercial banks. Their software is known for its scalability, security, and integration capabilities, enabling financial institutions to optimize loan servicing operations.

The global loan servicing software market is expected to witness significant growth in the coming years, driven by increasing demand for automated loan processing, regulatory compliance, and digital transformation in the financial services industry. To stay competitive, market players are focusing on innovation, strategic partnerships, and product enhancements to meet the evolving needs of their customers.

https://www.databridgemarketresearch.com/reports/global-loan-servicing-software-marketThe global loan servicing software market is poised for continued expansion and innovation as financial institutions adapt to changing customer expectations and regulatory requirements. A key trend shaping the market is the increasing focus on customer experience and operational efficiency. Loan servicing software providers are emphasizing user-friendly interfaces, automation of repetitive tasks, and integration with other financial systems to enhance the borrower experience and streamline operations for financial institutions.

Another significant driver of market growth is the rise of digital transformation in the financial services industry. With the shift towards online and mobile banking, there is a growing need for loan servicing software that can support digital channels, provide real-time data access, and ensure data security. Market players are investing in cloud-based solutions and advanced analytics capabilities to help financial institutions leverage data for personalized customer services and data-driven decision-making.

Regulatory compliance is a fundamental concern for financial institutions, especially in industries like banking, financial services, and insurance. Loan servicing software providers are continuously updating their solutions to ensure adherence to regulations such as GDPR, CCPA, and industry-specific standards. By offering features like automated compliance checks, audit trails, and reporting tools, software vendors help their customers mitigate regulatory risks and maintain trust with regulators and customers.

Moreover, the market players are ramping up their efforts in research and development to introduce innovative features like AI-driven loan processing, blockchain-based security solutions, and predictive analytics for risk management. These advanced technologies enable financial institutions to optimize loan servicing operations, detect fraud, and improve decision-making while reducing manual errors and operational costs.

In terms of market competition, key players like Fiserv, FIS Global, Finastra, Jack Henry & Associates, and Temenos Group are likely to face intensified competition from emerging startups offering niche solutions or disruptive technologies. Market consolidation through mergers and acquisitions may also reshape the competitive landscape, with larger players seeking to expand their product portfolios, customer base, and geographical reach.

Overall, the global loan servicing software market is entering a phase of rapid evolution and transformation, driven by technological advancements, changing customer preferences, and regulatory pressures. Market players need to adapt quickly to these trends, invest in innovation, and forge strategic partnerships to capitalize on emerging opportunities and sustain growth in a competitive marketplace.**Segments**

Global Loan Servicing Software Market, By Type (Cloud-Based, SaaS-Based, On-Premises), Applications (Banks, Credit Unions, Mortgage Lenders and Brokers, Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2029.

- The loan servicing software market, based on type, offers cloud-based, SaaS-based, and on-premises solutions catering to different customer needs and preferences.

- Various applications of loan servicing software include banks, credit unions, mortgage lenders and brokers, and other financial institutions, each requiring tailored solutions to meet their operational requirements.

- Geographically, the market is segmented into different countries, each with unique regulatory environments, competitive landscapes, and market dynamics influencing the adoption of loan servicing software.

**Market Players**

- Some of the major players operating in the loan servicing software market are DownHome Solutions, AUTOPAL SOFTWARE, LLC, Nortridge Software, LLC., Fiserv, Inc., Q2 Software, Inc., Emphasys Software, NBFC Software., Shaw Systems Associates, LLC, Simnang LLC, Graveco Software Inc., Oracle, Sopra Banking Software, Altisource., Nucleus Software Exports Ltd., IBM, LOAN SERVICING SOFT INC., and PCFS Solutions among others.

The global loan servicing software market is experiencing robust growth, primarily driven by the rising demand for efficient loan processing, adherence to regulatory requirements, and digital transformation in the financial services sector. Market players are focusing on innovation, strategic partnerships, and product enhancements to cater to the evolving needs of their customers and remain competitive in the market.

One of the key trends influencing the market is the increasing emphasis on customer experience and operational efficiency. Loan servicing software providers are prioritizing user-friendly interfaces, automation of repetitive tasks, and seamless integration with other financial systems to enhance the borrower experience and streamline operations for financial institutions.

Digital transformation plays a pivotal role in shaping the market landscape, with a growing requirement for loan servicing software that supports digital channels, provides real-time data access, and ensures robust data security. Cloud-based solutions and advanced analytics capabilities are being heavily invested in to enable financial institutions to leverage data for personalized customer services and data-driven decision-making.

Regulatory compliance remains a critical concern for financial institutions, especially in highly regulated industries like banking and insurance. Loan servicing software providers are continuously updating their solutions to ensure compliance with regulations such as GDPR, CCPA, and industry-specific standards. Automated compliance checks, audit trails, and reporting tools are being integrated into software offerings to help customers mitigate regulatory risks effectively.

Innovative features such as AI-driven loan processing, blockchain-based security solutions, and predictive analytics are being introduced through extensive research and development efforts by market players. These advanced technologies empower financial institutions to optimize loan servicing operations, detect fraud, and enhance decision-making processes while reducing manual errors and operational costs.

As the market intensifies, established players like Fiserv, FIS Global, and Finastra are expected to face increased competition from emerging startups offering niche solutions or disruptive technologies. Market consolidation through mergers and acquisitions may reshape the competitive landscape, with larger players seeking to expand their product portfolios, customer base, and global footprint.

The global loan servicing software market is entering a phase of rapid transformation, driven by technological advancements, evolving customer expectations, and regulatory pressures. Market participants must adapt swiftly to these trends, invest in innovation, and forge strategic alliances to capitalize on emerging opportunities and sustain growth in a competitive marketplace.

Explore Further Details about This Research Loan Servicing Software Market Report https://www.databridgemarketresearch.com/reports/global-loan-servicing-software-market

Key Insights from the Global Loan Servicing Software Market :

- Comprehensive Market Overview: The Loan Servicing Software Market is witnessing strong growth driven by increasing demand and technological advancements.

- Industry Trends and Projections: Key trends include automation, sustainability, and a shift towards digital solutions, with a projected CAGR of X%.

- Emerging Opportunities: Opportunities are emerging in green technologies, personalized services, and untapped geographical regions.

- Focus on R&D: Companies are heavily investing in R&D to drive innovation, especially in AI, IoT, and sustainable solutions.

- Leading Player Profiles: Dominant players like Company A and Company B lead the market with robust portfolios and global reach.

- Market Composition: The market is fragmented, with a mix of established companies and innovative startups.

- Revenue Growth: Revenue in the Loan Servicing Software Market is steadily increasing, fueled by rising consumer demand and expanding commercial applications.

- Commercial Opportunities: Commercial opportunities lie in entering emerging markets, digital expansion, and forming strategic partnerships.

Find Country based languages on reports:

https://www.databridgemarketresearch.com/jp/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/zh/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/ar/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/pt/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/de/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/fr/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/es/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/ko/reports/global-loan-servicing-software-market

https://www.databridgemarketresearch.com/ru/reports/global-loan-servicing-software-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 988