Global Ship Repair and Maintenance Services Market to Surpass USD 53 Billion by 2034, Fueled by Aging Fleets, Digitalization, and Environmental Regulations

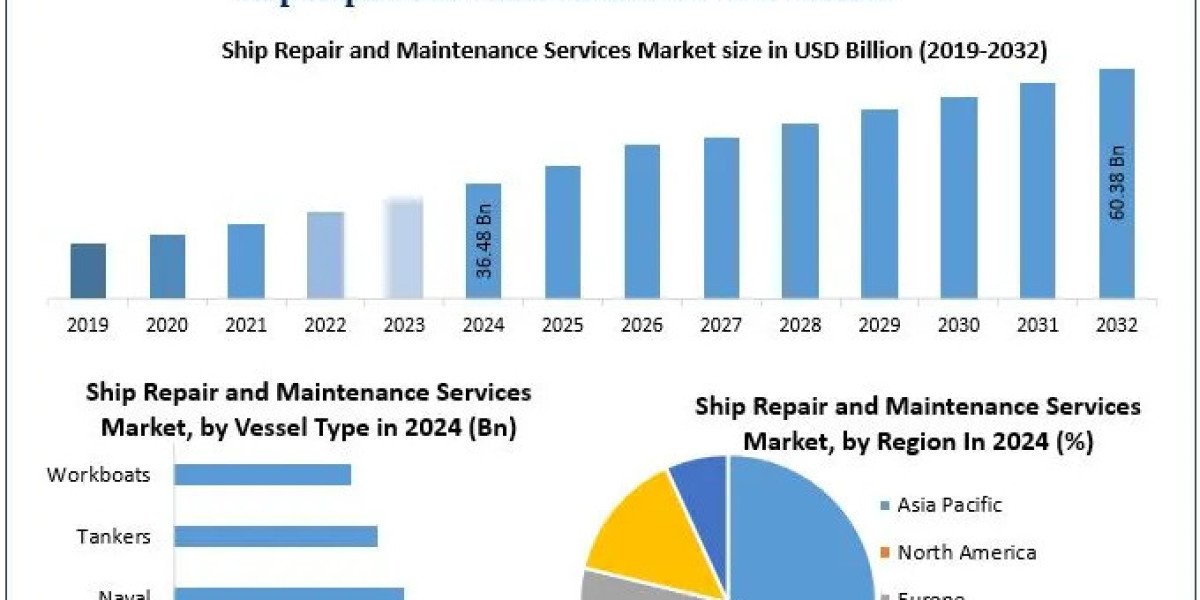

The global Ship Repair and Maintenance Services Market , valued at approximately USD 28.1 billion in 2024, is projected to nearly double to USD 53.3 billion by 2034, propelled by the rising age of the world fleet and stricter international maritime emissions regulations.

To know about the Research Methodology :https://www.maximizemarketresearch.com/request-sample/104905/

Market Growth Drivers & Opportunity

The industry is witnessing a remarkable shift driven by multiple converging trends. First, more than one-third of the global fleet exceeds 15 years in age, necessitating routine, compliance-driven dry‑dockings and retrofits to meet IMO emissions norms (EEXI, CII, sulfur caps). Second, the proliferation of digital technologies—IoT-based predictive maintenance, AI inspections, drones, robotics, and digital twins—is reducing downtime, cutting costs, and unlocking new service models. Third, growing investment in eco‑friendly solutions—such as biofouling coatings, engine retrofits, and scrubbers—is both regulatory and strategic, reflecting a broader push toward decarbonization.

Together, these factors create a rich opportunity for yard owners and service providers to offer value‑added, tech‑led maintenance and upgrade services, particularly as operators look to extend vessel life in an inflation‑pressured and sustainability‑focused era.

Segmentation Analysis

Segmentation within this market underscores the multifaceted scope of demand:

By Vessel Type, the commercial fleet segment—comprising bulk carriers, tankers, container ships, passenger vessels, and offshore support craft—dominates in volume and revenue, reflecting their sheer numbers and continuous utilization. Naval vessels, including warships, submarines, and auxiliaries, represent a smaller but technically complex and high-margin niche that demands specialized expertise.

By Service Type, general maintenance and hull services form the largest share, followed by engine components and electric systems overhauls. Dockage services split between graving docks, used for full dry‑dock repairs, and floating docks. A growing subset includes auxiliary services, emergency collision repairs, and conversion projects, which are gaining traction as fleets age.

By End‑User, commercial shipping accounts for the bulk of volume, but government and defense segments—particularly naval MRO—are steadily growing, driven by geopolitical tensions, fleet modernization, and long-term service contracts.

By Region, Asia-Pacific leads in total repair contracts, followed by North America and Europe. However, emerging hubs and a resurgence of allied-industry collaboration are strengthening regional diversification.

Country-Level Analysis

United States: Anchored by tight Coast Guard and environmental regulations, the U.S. market continues stable growth around 4–5% annually. Strategic partnerships with South Korean and Japanese yards mean rising foreign participation in U.S. Navy contracts. Domestic yards are also investing in digital inspection platforms and decarbonization services.

Germany: A core European hub, Germany is embracing robotics, digital twins, and smart predictive maintenance within its yards. German ship repair centers serve registries across Northern Europe and maintain strong ties to the offshore wind sector, which is expanding maintenance demand.

China: Leading with the fastest regional CAGR (~7%), China’s shipyards are scaling retrofit capabilities for bulk carriers, LNG conversions, and environmental upgrades. With its vast commercial fleet, China represents both scale and technological advancement.

South Korea: Anchored by giants such as HD Hyundai, South Korea is making inroads into the global naval MRO space. Hyundai now holds master repair agreements with the U.S. Navy and is modernizing its U.S. shipyard operations.

India: Emerging at the intersection of military and commercial maintenance, Indian yards (e.g., Cochin, Larsen & Toubro’s Kattupalli) are gaining U.S. Navy MSRAs and expanding domestic repair capacity, reflecting a surge in indigenous MRO development.

Italy: Anchored by Fincantieri’s global expansion—modernizing European defense shipyards and winning cruise ship repair contracts—the Italian market is showcasing integrated eco‑services, waste management partnerships, and sophisticated naval overhauls.

Request Free Sample Report:https://www.maximizemarketresearch.com/request-sample/104905/

Competitor Analysis

Leading players listed in the market report include:

Damen Shipyards Group

Sembcorp Industries Ltd.

Cochin Shipyard Limited

China Shipbuilding Industry Corporation (CSIC)

Fincantieri S.p.A.

Dae Sun Shipbuilding & Engineering

Hyundai Mipo Dockyards

Arab Shipbuilding & Repair Yard

DORMAC Ship Repairs

Alexandria Shipyard

Moreover, global shipbuilding leaders including HD Hyundai Heavy Industries, Fincantieri, Wärtsilä, Harland & Wolff, and A&P Group are bolstering their positions through strategic developments and contracts.

Top five global players by market share and footprint include HD Hyundai HHI, Fincantieri, Damen, CSIC, and Wärtsilä.

Recent Strategic Developments:

HD Hyundai HHI signed a U.S. Navy master ship repair agreement in 2024, cementing its entry into the U.S. naval MRO space.

Fincantieri completed a major acquisition to strengthen Italian naval repair capacity and secured high-value cruise ship repair and waste‑management partnerships in 2024–25.

Wärtsilä is transitioning into a digital marine service leader, acquiring multiple tech firms and launching digital acceleration centers focused on IoT, predictive analytics, and digital twins.

Harland & Wolff, under new ownership, is investing in UK repair assets and preparing for naval replenishment vessel contracts starting in 2025.

India’s Larsen & Toubro secured a five‑year Master Ship Repair Agreement with the U.S. Navy at Kattupalli, signaling its rise in Indo‑Pacific repair capacity.

Conclusion

As the world fleet ages and sustainability mandates deepen, the ship repair and maintenance services market is entering a strategic inflection point. With global spending expected to reach over USD 53 billion by 2034, industry players that can combine technical excellence, green retrofitting, and advanced digital solutions will lead the pack.

Success in this evolving landscape depends on forging long-term government contracts, investing in IoT and AI-driven uptime services, and building green-capable infrastructure. Leading yards in the U.S., Europe, Asia, and evolving markets like India and South Korea are already moving in this direction.

For maritime operators, yard owners, service innovators, and investors, the signal is clear: the next decade belongs to intelligent, sustainable, and integrated ship maintenance ecosystems—and those positioned to navigate this transformation will reap the rewards.