Quickswap is an automated liquidity protocol based on a constant product formula and employing a system of non-upgradable smart contracts on the Ethereum blockchain. Security, resistance to censorship, and decentralization are prioritized, so it eliminates the need for trustworthy intermediaries. Quickswap, a piece of open-source software, is covered by the GPL.

A liquidity pool contained two ERC-20 tokens is overseen by each Quickswap shrewd comprehension, or match.

By putting away indistinguishable amounts of each secret token, anybody can turn into a liquidity provider (LP) for a pool in return for pool tokens. These tokens are recoverable at any time for secret assets and track goods that can be used to split LP portions of the full-scale saves.

Matches function as electronic market makers, always prepared to accept one token in exchange for another as long as the "steady thing" recipe is followed. According to this formula (x * y = k), trades cannot alter the product (k) of a pair's reserve balances (x and y). The way that k excess parts steady regardless of what the trade's reference frame is suggested as "invariant." The fact that larger trades execute at exponentially worse rates in relation to reserves than smaller trades is a desirable feature of this formula.

In practice, Quickswap charges a 0.30 percent fee to trade reserves. So, when LPs use their pool tokens to get their share of all out holds, each exchange effectively raises k, which is paid to them. In the future, this fee may be reduced to 0.25 percent, leaving the remaining 0.05 percent as a cost for the entire protocol.

Because trading is the only way to alter the relative prices of the two pair assets, divergences between the Quickswap price and external prices present opportunities for arbitrage. Because of this system, the price of quick trades tends to be closer to the value that clears the market.

Truly examining: For details about the lifecycle of a swap and how token swaps work in practice, see Swaps. On the other hand, for more information regarding the activity of liquidity pools, see Pools.

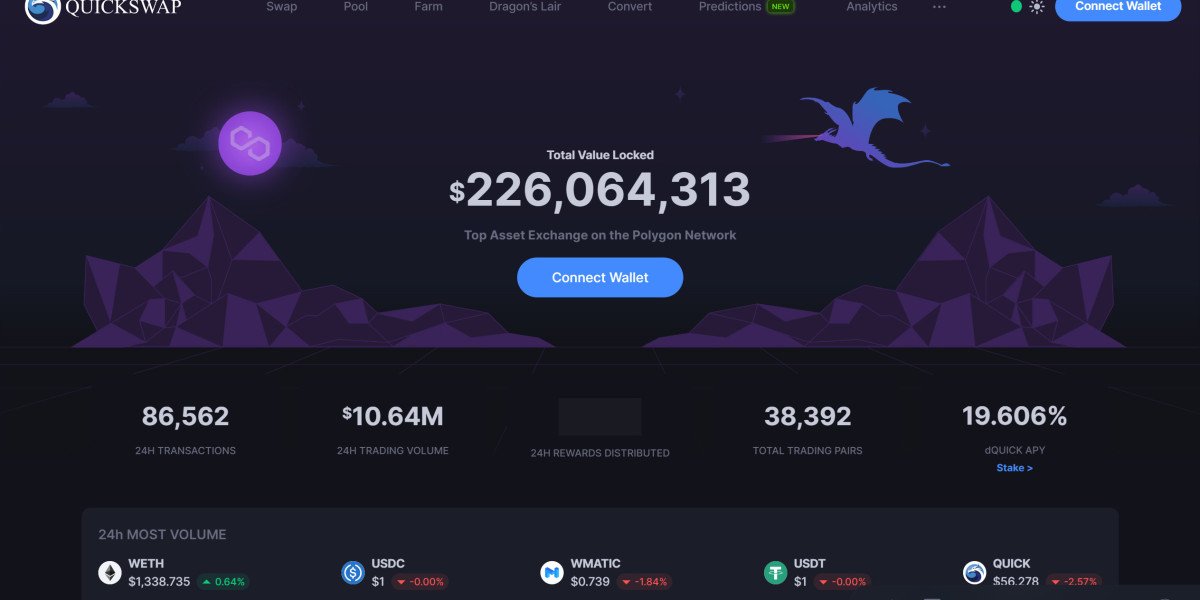

The Quickswap convention is simply code for Ethereum-based shrewd agreements eventually. Visit Shrewd Agreements to learn more about them. QuickSwap is a Polygon Network-based decentralized exchange (DEX). The automated market-making model and the liquidity pool concept are utilized by the platform in order to make it possible for users to earn Quickswap exchange transaction fees from token swaps.

Copyright 3Commas.io is a platform with DCA bots, Grid bots, Options bots, Futures bots, HODL bots, and Scalper Terminal for managing cryptocurrency trades with a single, straightforward interface. Additionally, it provides full Portfolio management.