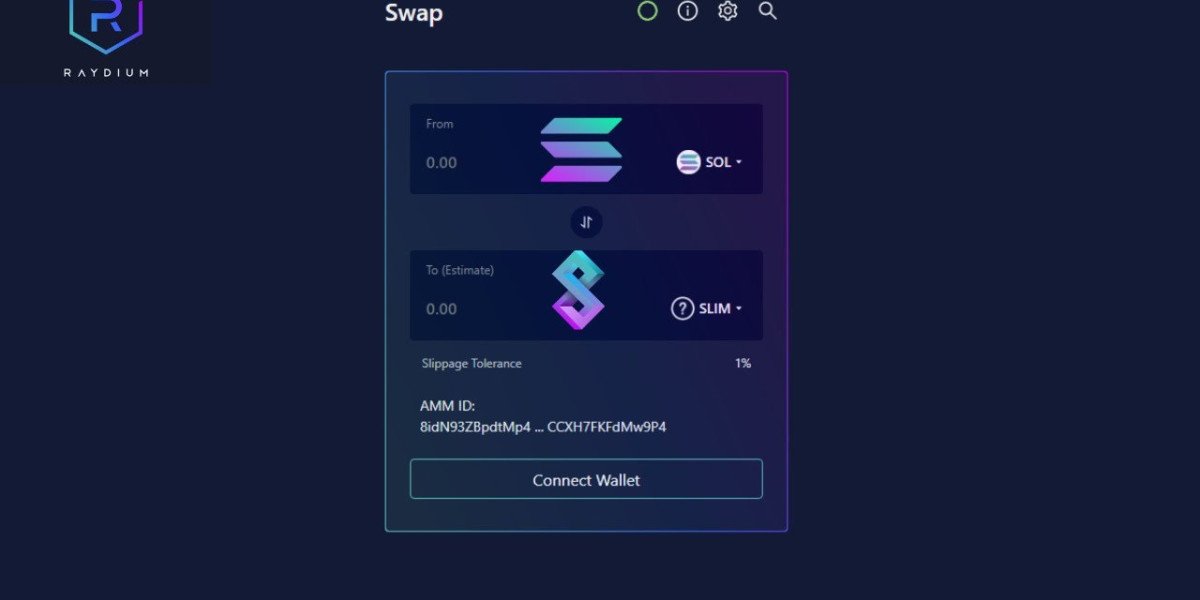

Raydium: What exactly is it? An automated market maker (AMM) model powers Raydium, a Solana-based decentralized exchange (DEX) for radiyum, raydium swap, and raydium swap. Swapping, trading, and providing liquidity are all available to users. Serum, another Solana-based exchange with a central order book model, receives liquidity from the exchange. As a result, users of Raydium have access to Serum's liquidity and order flow. In addition, the stage asserts that it has the most cost-effective trade include, thereby determining whether the liquidity pool or serum request book are better options for carrying out symbolic trades.

LP tokens, which are tokens that represent a proportion of the pooled assets, can also be added by users to increase liquidity. Holders of LP tokens receive 0.22 percent of the trade volume each time a token swap occurs. It is divided based on how committed the pool is to liquidity. The serum demand book can also be used to place orders through permissionless pools. Users will share in trading fees when token pairs are added.

To acquire additional RAY tokens, you can stake the native token. Additionally, it is a governance token that can be used to vote on exchange fee and enhancement proposals.

Who is responsible for creating Raydium?

AlphaRay is in charge of Raydium's overall strategy, operations, product direction, and business development. Since moving its concentration from product algorithmic exchanging to the formation of digital currency markets and the arrangement of liquidity in 2017, Alpha has not thought back. Alpha realized that the market required an AMM for the request book to bring liquidity together after sending DeFi off in late spring 2020. For the purpose of confronting the issue head-on with the release of Serum, the company assembled a team of seasoned trading developers. Chief of Technology and Dev Team leader at Raydium is XRay. X has been a trading and low latency systems architect for cryptocurrency and traditional markets for the past eight years. GammaRay is in charge of Raydium's system and infrastructure, marketing and communications, and product strategy and direction. Gamma worked on client engagements and corporate marketing for a significant portion of his career at a well-known company that specializes in data analytics and market research. Technical analysis and discretionary trading were among Gamma's previous cryptocurrency ventures.

When was the initial release of Raydium?

On February 21, 2022, Raydium went live.

Where Can I Find Raydium?

The trade does not specify where it can be found on its Crunchbase profile.

Belarus, the Central African Republic, the Democratic Republic of the Congo, North Korea, the Crimea, the Donetsk and Luhansk regions of Ukraine, Cuba, Iran, Libya, Somalia, Sudan, South Sudan, Syria, the United States, Yemen, and Zimbabwe all prohibit access to or use of the Raydium Protocol.

An Overview of the Coins Held by Raydium Raydium is the holding company for all SPL Radiyum, Raydium Trade, and Raydium Exchange tokens that are associated with Solana.

What is the price of Raydium fees?

As of this writing, the Radiyum, Raydium, and Raydium Swap has a trading fee of 0.25 percent, with 0.22 percent going to liquidity pools as a fee reward and 0.03 percent going to the exchange pool for staking.

On Raydium, can leverage or margin trading be used?

Raydium does not provide margin trading or leverage.